Protecting Your Wealth From Stock Market Losses With Fixed Indexed Annuities (FIAs)

What you are about to learn will be very exciting to you.

For more information and to learn how you can use FIAs to protect and grow your wealth, please contact our office at click here to email us.

For readers who lost 40%+ when the stock market crashed in 2000-2002 and 40-50-60% when it crashed in 2007-March of 2009, this material will be a real eye-opener.

This material covers Fixed Indexed Annuities (FIAs) and why you may want to use them as one of your protective wealth-building/retirement tools.

Why FIAs? Because they can have the following characteristics:

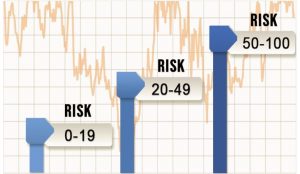

100% principal protection (your money will never go backward due to negative returns in the stock market).

Positive gains in a stock index are locked in every year.

An Income Account Value* (not walk away value) that could provide a guaranteed lifetime income* you can never outlive!

*Any guarantees mentioned are backed by the financial strength and claims-paying ability of the issuing insurance company and may be subject to caps, restrictions, fees, and surrender charges as described in the annuity contract.

Does a wealth-building tool with the above-mentioned characteristics interest you?

Why don’t you know about this product?

What might interest you is that some Broker-Dealers (the entity who securities licensed advisors to sell their stock and mutual funds through) forbid the advisors from selling or discussing FIAs with clients.

What’s worse is that most of these same advisors who are forbidden from selling FIAs do NOT disclose that to the clients or potential clients they are supposedly helping build wealth.

We believe that FIAs can play a vital role for people looking to grow wealth in a secure manner (meaning they can sleep better at night knowing their money will never go backward.

Guaranteed Income For Life

What there was an annuity that came with an Income Account Value* (not walk away value) that could provide a guaranteed lifetime income* you can never outlive? Would that interest you?” We think most people would like to learn about this product and so we added the safe money tool #2 video below for viewing by those who are interested.

Index or fixed annuities are not designed for short-term investments and may be subject to caps, restrictions, fees, and surrender charges as described in the annuity contract. Guarantees are backed by the financial strength and claims-paying ability of the issuer.

Product changes

There are a number of different FIAs with guaranteed income riders in the marketplace. These products change periodically and the goal with this page and video is to make you aware that these products exist and to explain how they work.

Questions?